Posted February 20, 2014 10:25

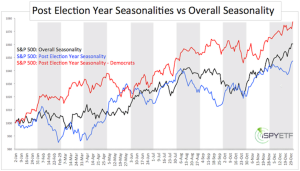

A seasonality chart is one of the best charts, especially when the first two months of the year match up almost perfectly with those seasonality trends. More specifically, I am looking at the mid-year presidential cycle seasonality chart. The chart tells us that there is going to be a rally in March and April. I am giving that prediction a lot of credence because this very same chart predicted a pullback in January, which is exactly what happened.

I want to play this rally in a very simple manner. I recently bought the May SPY 187 call for $3.25. Some of you may be asking why did you pay so much for a call? The reason is that I am going to put into play a call calendar strategy. This is when you sell shorter-term calls against your longer-term calls. I am hoping to collect around $0.10 to $0.20 per week for the next 10 weeks. This would, in turn, bring my cost down to $1.25-$2.25. Furthermore, if the S&P 500 index can hold 1850, I believe it will head to 1900 in short order.

The reasons are as follows:

– First, I think the Jobs Report will be a non-event, as the market brushes off any bad news;

– Second, 1850 is a significant level of resistance; if we can hold that level, I think the result would be short-covering;

– And lastly, I think that the next psychological level of resistance is 1900 and at that point I would expect the market to somewhat stall.

Source: http://www.ispyetf.com/view_article.php?slug=Not_Your_Average_2013_Performance_Report&ID=330

If the SPY were to hit 190 by March expiration, I would likely take off my May calls. If that were the case, I probably would not be able to sell that much premium (if the market rallied that quickly and seemed to have a lot of momentum, I would not want to cap my upside on my May calls).

In that case, I would expect a 100% gain. I was looking at a few individual names like Tesla, Amazon, and LinkedIn, but I was too slow to get in and, therefore, missed the opportunity in their gains. I think that the momentum names will continue to go higher, but I would only trade those names on a weekly basis instead of medium/long term basis.